JAC Board Class 10th English Grammar Factual Passages

JAC Class 10th English Grammar Factual Passages Textbook Questions and Answers

Factual Passages

1. Read the passage carefully.

Write-downs to surge for cos as Covid hits demand

Will Squeeze Profits, Or Even Push Them Into The Red

An increasing number of Indian companies are staring at write-downs in their business this fiscal as they will be forced to record the demand-collapse for their products on profit and loss accounts due to the pandemic.

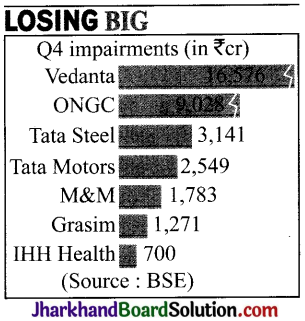

They will have to provide for impairments starting June quarter, which could either pull their profits lower or push them into losses. Early signs of Covid-19 related impairment charges were visible in some entities when they announced their fourth quarter numbers for fiscal 2020. Industry watchers expect impairments to accelerate going forward.

Vedanta, for instance, took an exceptional charge of Rs- 17,132-crore in the three months through March of fiscal 2020, mainly due to the Rs-16,576-crore impairment of assets in its oil and gas business, triggered by the fall in crude oil prices following the coronavirus outbreak.

“Impairments are triggered due to falling demand/revenue/profitability, rising losses, increased competition intensity, among other factors. The cumulative effect of which is to reduce the economic viability of the subject business,” said RBSA Advisors MD Rajeev Shah. “Where the subject business is into commodities, it suffers a double whammy, wherein falling demand immediately triggers fall in prices, putting the company in a miserable position.”

Since Covid-19 manifested in the fourth quarter, companies have been making judgments and estimates on the impact of the pandemic on their business and have been reflecting the same in their impairment assessments while finalising their annual accounts.

“We don’t expect this (write-downs) to be a one time impact as most companies will need to continuously monitor the situation and reassess the economic scenarios that could play out in the future,” said KPMG partner Sai Venkateshwaran. “Where the assessment continues to show a decline or a prolonged impact on business, companies may need to record further losses in the coming quarters and we can expect to see more of these reflected on a quarter-by-quarter basis rather then only in the last quarter of fiscal 2021.”

Generally, firms carry out asset impairment assessments as and when there is an indication of a . possible impact from either external or internal indicators. However, for goodwill and intangible assets, companies typically carry out assessments in the fourth quarter as this coincides with the annual audit process. Companies in the non-essential businesses – such as automobiles, hospitality, aviation and shadow banking – are expected to take impairments on inventories and recoverability of loans/receivables this fiscal.

RBSA Advisors MD Ravishu Shah pointed out that certain businesses had been weak even before the onset of Covid-19 and the pandemic has only made matters worse for them. These companies have taken impairments in the fourth quarter.

Globally, capital-intensive sectors like energy, airlines and steel have been hit the hardest with impairments. (Courtesy: The Times of India)

Word-Meaning: Staring – gazing, Accelerate – speed up, Cumulative – growing, Triggers – activate, Whammy – an evil influence

![]()

On the basis of your understanding of the above passage, answer any ten of the questions given below by choosing the most appropriate option: [10 x 1 = 10]

a. Impairment of Vedanta’s assets in oil and gas business accounted for

(i) Rs. 17,132 crore

(ii) Rs. 16,570 crore

(iii) Rs. 16,575 crore

(iv) Rs. 16,576 crore

Answer:

(iv) Rs. 16,576 crore

b. What factors are triggering impairments?

(i) Falling demand, revenue, profitability, rising losses, increase in competition

(ii) Falling demand, profitability and rising losses

(iii) Profitability, rising losses and increase in competition

(iv) Profitability, rising losses and economic crisis

Answer:

(i) Falling demand, revenue, profitability, rising losses, increase in competition

c. What triggered impairment in oil and gas business?

(i) Rising prices

(ii) Fall in crude oil prices

(iii) Increasing competition

(iv) Falling demand

Answer:

(ii) Fall in crude oil prices

d. Which business is likely to suffer a double whammy?

(i) Commodity

(ii) Crude oil

(iii) Steel

(iv) Motors

Answer:

(i) Commodity

e. “Write downs are not a one-time impact on companies.” Who said this?

(i) Rajeev Shah

(ii) Ravishu Shah

(iii) Sai Venkatcshwaran

(iv) None of the above

Answer:

(iii) Sai Venkatcshwaran

f. Losses in business will be reflected

(i) in a quarter-by-quarter basis

(ii) in the last quarter of fiscal 2021

(iii) in the third quarter of fiscal 2021

(iv) in the coming quarters

Answer:

(i) in a quarter-by-quarter basis

g. Firms generally carry out asset impairment assessment when

(i) cumulative etlect reduces the economic viability

(ii) demand is more than supply

(iii) supply is more than demand

(iv) there is a possible impact from either external or internal indicators.

Answer:

(iv) there is a possible impact from either external or internal indicators.

h. In which business impairments on inventories and recoverability of loans are available?

(i) Essential businesses

(ii) Non-essential businesses

(iii) Both (i) and (ii)

(iv) None of these

Answer:

(ii) Non-essential businesses

![]()

i. Which sectors are worst affected with the impairmenh?

(i) Energy, airlines, and steel

(ii) Automobiles, hospitality. axd aviation

(iii) Automobile, energy, and airlines

(iv) Essential and non-essential businesses

Answer:

(i) Energy, airlines, and steel

j. Which company has lest impairments, according to the graph?

(i) Grasim

(ii) MSM

(iii) Tata Steel

(iv) IHH Health

Answer:

(iv) IHH Health

k. What has made the matter from bad to worst?

(i) Covid-19

(ii) Rising prices

(iii) Decrease in production

(iv) None of these

Answer:

(i) Covid-19

l. Who pointed out that certain businesses had been weak even before the onset of Covid-19?

(i) sai venkateswaram

(ii) rajeev Shah

(iii) Ravish Shsh

(iv) None of these

Answer:

(iii) Ravish Shsh

![]()

2. Read the passage carefully.

Retail gold prices go past ₹ 50k/10gm mark

Surge 57% in 2 Years | Seen At ₹ 80K by End 21

A strong global demand for gold, along with a depreciating rupee, helped the yellow metal to breach the Rs-50,000-per-10gm mark in Mumbai’s retail market on Wednesday. This is the first time the price of the precious metal, with which Indians associate sentimentally, crossed the psychologically important level.

At the same time, on leading commodities bourse MCX, the price was hovering just below Rs-49,000 mark for contracts that will expire in August’s first week.

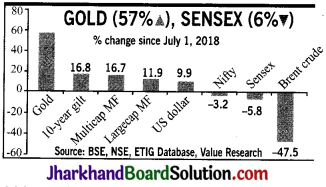

According to data analysed by TOI, gold started moving up only after mid-2018, till when its price was range-bound at Rs-30,000-32,000 for several years. In the last two years, the return from the precious metal has been a staggering 57%. In the process, it has outperformed all other asset classes. The 10-year gilts — with nearly 17% returns — are the next best asset class.

On Tuesday night on the Nymex in New York, gold prices neared an eight-year high at just above the $ 1,800-per ounce mark. This helped domestic prices shoot up during the day, market players said. According to Motilal Oswal Financial Services VP (commodities research) Navneet Damani, gold surged to its highest in nearly eight years as mounting fears of a resurgence of new coronavirus cases kept safe-haven demand for the yellow metal alive. This set the precious metal on the path to its biggest quarterly gain since March 2016.

With stocks and bonds as investments not showing much hope for good returns in the next few years, gold stands out as the asset class that could give strong returns, a recent research report by Bank of America Securities said. The report had predicted that by end-2021, the price of gold could rally up to $ 3,000 per ounce which when translated into Indian rates could be upwards of Rs-82,000/1 Ogm at current exchange rates.

The factors that are aiding the gold-price rally are the uncertainties regarding the Hong Kong issue, fears about a second wave of Covid-19 infections slowing global economic growth further and the promise of central banks to infuse money into the financial system to fight the virus infection with a “whatever-it-takes” approach, industry players said.

“US treasury secretary Steven Mnuchin and Fed governor Jerome Powell pledged to do more for the US economy as it battles the enormous fallout from the virus outbreak,” Damani wrote in a note. (Courtesy: The Times of India)

Word-Meaning: Beach – violation, Surge – flow, outpouring, Asset – property

![]()

On the basis of your understanding of the above passage, answer any ten of the questions given below by choosing the most appropriate option: [10 x 1 = 10]

a. Which of the following metals is sentimentally associated with Indians?

(i) Copper

(ii) Gold

(iii) Diamond

(iv) Silver

Answer:

(ii) Gold

b. What happened for the first time, according to the passage?

(i) Demand of goal decreased.

(ii) The price of gold crossed the psychologically important level.

(iii) Global demand for gold increased.

(iv) None of these

Answer:

(ii) The price of gold crossed the psychologically important level.

c. Who is the treasury secretary of US?

(i) Jerome Powell

(ii) Damani

(iii) Steven Mnuchin

(iv) None of these

Answer:

(iii) Steven Mnuchin

d. What are the factors that are aiding the uncertainties regarding gold price rally?

(i) Hong Kong issues

(ii) Fears of Covid-19

(iii) Central banks promise to infuse money into financial system to fight the virus.

(iv) All of the above

Answer:

(iv) All of the above

e. Who pledged to do more for the US economy?

(i) US treasury secretary

(ii) Steven Mnuchin and Jerome Powell

(iii) American citizens

(iv) None of these

Answer:

(ii) Steven Mnuchin and Jerome Powell

![]()

f. According to the report, what can provide the strong returns in next few years?

(i) Stocks and investments

(ii) Gold

(iii) Stocks and gold

(iv) All of the above

Answer:

(ii) Gold

g. According to the data analysed by TOI, from which year gold started moving?

(i) January 2020

(ii) March 2016

(iii) mid-2018

(iv) December 2019

Answer:

(iii) mid-2018

h. What could be the price of gold at the end of 2021, when translated into Indian rates?

(i) Rs.80,000 per 10 gm

(ii) Rs.3,000 per ounce

(iii) Rs. 50,000 per 10 gm

(iv) Rs.82,000 per 10 gm

Answer:

(iv) Rs.82,000 per 10 gm

i. What helped gold to breach the Rs.50k per lOgm mark?

(i) Indian sentiments

(ii) Strong global demand for gold

(iii) Depreciating rupee

(iv) Both (ii) and (iii)

Answer:

(iv) Both (ii) and (iii)

j. In the last two years, the return from gold has been staggering %

(i) 16.6%

(ii) 17%

(iii) 57%

(iv) 74%

Answer:

(iv) 74%

k. Where is Nymex?

(i) Mumbai

(ii) New York

(iii) Sweden

(iv) Paris

Answer:

(ii) New York

l. Which investments are not showing much hope returns in the next few years?

(i) Stocks

(ii) Bonds

(iii) Gold

(iv) Both (i) and (ii)

Answer:

(iv) Both (i) and (ii)

![]()

3. Read the passage carefully.

Govt prods PSUs to step up capex to revive eco growth

FM Looks at Infra Push to Create Demand, Employment

Finance minister Nirmala Sitharaman on Tuesday sought to push capital expenditure by the country’s top public sector companies, as part of the government’s drive to boost investment in the economy and revive growth.

Separately, the government is looking at ways to fast-track some of the investment as part of the over Rs-100-lakh-crore National Infrastructure Pipeline as higher spending in creating assets is expected to spur the demand for cement, steel and other crucial inputs, in addition to creating employment.

Sitharaman discussed the capex plan of 23 public sector companies with their CMDs and secretaries of ministries of petroleum, power, coal, mines and atomic energy. These state-run companies, including Indian Oil, NTPC, Coal India, NMDC and SAIL, have been the Centre’s go-to entities to not just step up investment but also to milch them at the end of the year by seeking hefty dividends for the government to meet its revenue targets.

“This meeting was held as part of the series of meetings that the finance minister is having with various stakeholders to accelerate economic growth,” an official statement said.

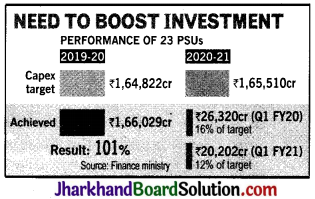

While PSUs had over-achieved the capex target during the last financial year, they are seen to be lagging in the first quarter of the current fiscal due to the lockdown, which forced companies to put projects on hold. In fact, several companies have complained of a manpower crunch holding full-scale resumption. The manpower issue is, however, expected to be sorted out in the coming weeks as migrant workers are slowly returning.

“The ministries/CPSEs discussed constraints being faced by them due to Covid-19 like problems of availability of manpower, delay in imports, delay in payments by discoms on the dues of CPSEs like NPCIL and NLC (Neyveli Lignite). Sitharaman states that the extraordinary situation requires extraordinary efforts and, with collective effort, “we will not only perform better but also help the Indian economy to achieve better results”, the statement added.

Ministries have been instructed to ensure that the PSUs step up their capex significantly during the current quarter itself to ensure that half the spending for the current financial year is completed by September, with all concerns and pending issues to be flagged immediately so that a solution can be found. (Courtesy: The Times of India)

Word-Meaning: Fiscal – relating to government revenue, Resumption – restart, Extraordinary – exceptional, Flagged – marked

![]()

On the basis of your understanding of the above passage, answer any ten of the questions given below by choosing the most appropriate option: [10 x 1 = 10]

a. Nirmala Sitharaman discussed the capex plan with public sector companies.

(i) 11

(ii) 12

(iii) 22

(iv) 23

Answer:

(iv) 23

b. What is the full form of PSUs?

(i) Public Sector Units

(ii) Public Sector Undertakings

(iii) Power Supply Units

(iv) Public Sector Union

Answer:

(iii) Power Supply Units

c. What was the capex target of 23 PSUs in 2019-20?

(i) 1,84,822 lakh

(ii) Rs. 1,65,822 lakh

(iii) Rs. 1,64,822 crore

(iv) Rs. 1,64,822 lakh

Answer:

(ii) Rs. 1,65,822 lakh

d. Finance Minister Nirmala Sitharaman sought to push capital expenditure to

(i) boost investment in the economy and revive growth

(ii) increase performance of public sector companies

(iii) create employment opportunities

(iv) none of the above

Answer:

(i) boost investment in the economy and revive growth

e. The sanctioned amount for National Infrastructure Pipeline is

(i) Rs. 110 lakh crore

(ii) Rs. 100 lakh crore

(ii) Rs. 120 lakh crore

(iv) Rs. 115 lakh crore

Answer:

(ii) Rs. 100 lakh crore

f. Which state-run companies are relying on the centre to meet its revenue targets?

(i) Indian Oil, NTPC, Coal India, NLC

(ii) Indian Oil, NTPC, Coal India, NMDC

(iii) Indian Oil, NTPC, Coal India, NMDC and SAIL

(iv) None of these

Answer:

(iii) Indian Oil, NTPC, Coal India, NMDC and SAIL

g. What is the capex target of 23 PSUs in 2020-21?

(i) Rs 6,500 crore

(ii) Rs 1,65,510 crore

(iii) Rs 6,000 crore

(iv) Rs 1,00,410 crore

Answer:

(ii) Rs 1,65,510 crore

![]()

h. In the first quarter of FY 2020 …………….. of the target could be achieved for 2020-21.

(i) 12%

(ii) 16%

(iii) 11%

(iv) 15%

Answer:

(ii) 16%

i. The status of PSUs during current year is lagging due to

(i) less production

(ii) lockdown

(iii) lack of manpower

(iv) delay in payments

Answer:

(ii) lockdown

j. What has the ministries been instructed?

(i) To ensure PSUs step up their capex significantly during the current quarter.

(ii) To ensure half the spending for the current financial year.

(iii) Both (i) and (ii)

(iv) None of the above

Answer:

(i) To ensure PSUs step up their capex significantly during the current quarter.

k. What does the term ‘fast-track’ mean in the passage?

(i) To dimmish

(ii) To accelerate

(iii) To decrease

(iv) None of these

Answer:

(ii) To accelerate

l. Which issues are expected to be sorted out in the coming weeks?

(i) Price issue

(ii) Manpower issue

(iii) Production issue

(iv) Employment issue

Answer:

(ii) Manpower issue

![]()

4. Read the passage carefully.

Banks to raise nearly ₹ 80k crore in equity capital

Pvt Banks Account For Most, But SBI, PNB To Tap Mkt Too

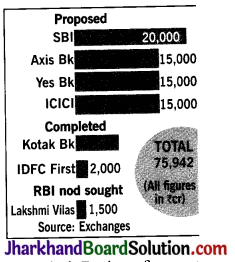

ICICI Bank’s board approved a proposal to raise Rs-15,000 crore through issue of fresh equity. This has taken the tally of completed and proposed equity issuances by banks this year to nearly Rs- 80,000 crore.

Banks are taking advantage of the buoyancy in the capital market, making it the largest fund-raise from the markets in any year.

The bulk of the capital is being raised by private banks who have already crystallised their plans, while public sector lenders like SBI and PNB have also said that they will tap the market.

One positive aspect of the supportive capital market is that banks are likely to raise most of the additional funds requirement on account of the Covid-19 forecast by rating agencies. Earlier this month, Fitch Ratings forecast that Indian banks will require $15 billion (Rs 1.13 lakh crore) in a moderate stress scenario. In June, ICRA had said that public sector banks will need between Rs 45,000 crore and Rs 82,500 crore in additional capital as slippages increase by 5%. The rating agency placed the capital requirement by private banks between Rs 25,000 crore and Rs 48,300 crore.

Private lenders Kotak Mahindra Bank and IDFC First Bank were the first off the block. Kotak Bank mobilised Rs 7,442 crore in May, which helped it meet the RBI directive on dilution of promoter stake. Yes Bank has also firmed up plans for a public offer, in which SBI said it will invest up to Rs 1,760 crore.

In the public sector, SBI has an enabling provision from its board to raise Rs 20,000 crore and PNB’s board will meet on Thursday to approve a capital raise. Besides pure equity banks are also looking at raising funds by issuing quasi-equity bonds which qualify for the purpose of capital adequacy. HDFC Bank has obtained approval to raise Rs 50,000 crore by way of additional tier-1 bonds. Bank of Baroda and Indian Bank are also looking at raising Rs 2,000 crore and Rs 5,000 crore by way of quasi-equity.

Besides issuing equity, banks have been improving their capital position by selling stakes in insurance subsidiaries. The insurance business has been relatively less impacted by the Covid-19 crisis in the financial sector. In June, ICICI Bank sold a 1.5% stake in ICICI Prudential Life Insurance for Rs 840 crore bringing down its stake to 51.4%. It also divested 3.96% in its general insurance arm for nearly Rs 2,250 crore.

In the public sector, SBI sold 2.1% stake of its stake to its subsidiary SBI Life Insurance for Rs 1,522 crore. IDBI has obtained board permission to sell part of its stake to its JV partners — Belgian insurer Ageas will by 23% stake, while Federal Bank will by 4%. (Courtesy: The Times of India)

Word-Meaning: Buoyancy – cheerfulness, Crystallise – harden, Subsidiaries – a company^ ^controlled by holding companies, Slippages – the process of subsiding

![]()

On the basis of your understanding of the above passage, answer any ten of the questions given below by choosing the most appropriate option: [10 x 1 = 10]

a. Which proposal has recently been approved by ICICI Bank’s board, according to the passage?

(i) To raise $ 15,000 crore through issue of fresh equity.

(ii) To earn Rs. 80,000 crore by the end of year.

(iii) To raise Rs.15, 000 crore through issue of fresh equity.

(iv) All of the above

Answer:

(iii) To raise Rs.15, 000 crore through issue of fresh equity.

b. What is the positive aspect of the supportive capital market?

(i) Banks are not looking for rising funds and issuing equity bonds.

(ii) Banks are likely to raise most of the additional funds requirement on account of Covid-19 forecast by rating agencies.

(iii) SBI and PNB have said that they will tap the market.

(iv) Banks are looking at Rs. 2,000 crore and Rs. 5,000 crore by the way of quasi-equity.

Answer:

(ii) Banks are likely to raise most of the additional funds requirement on account of Covid-19 forecast by rating agencies.

c. How much amount has been mobilised by the Kotak Mahindra Bank in May?

(i) Rs. 7,443 crore

(ii) 25,000 crore

(iii) Rs. 48,300 crore

(iv) Rs. 7,442 crore

Answer:

(iv) Rs. 7,442 crore

d. How the banks are improving their capital position?

(i) By the investment of equity shareholders

(ii) By selling stakes in insurance subsidiaries

(iii) By adding more equity shareholders

(iv) By not selling stakes in insurance subsidiaries.

Answer:

(ii) By selling stakes in insurance subsidiaries

e. Which of the following businesses have been relatively less impacted by the Covid-19 crisis in the financial sector?

(i) Telecom business

(ii) Banking business

(iii) Insurance business

(iv) Industrial business

Answer:

(iii) Insurance business

f. Which bank obtained the approval to raise Rs. 50,000 crore by way of additional tier-1 bonds?

(i) ICICI bank

(ii) Kotak Mahindra bank

(iii) HDFC bank

(iv) SBI and PNB banks

Answer:

(iii) HDFC bank

g. How much % of stake has SBI sold to SBI Life Insurance?

(i) 1.2%

(ii) 2.1%

(iii) 1.3%

(iv) 3.1%

Answer:

(ii) 2.1%

h. Bank of Baroda and Indian Bank are looking at raising …………… and ………… by way of quasi-equity respectively.

(i) Rs.2,000 crore / Rs.5,000 crore

(ii) Rs.80,000 crore / Rs.5,000 crore

(iii) Rs.20,000 crore / Rs.50,000 crore

(iv) Rs.5,000 crore / Rs.2,000 crore

Answer:

(i) Rs.2,000 crore / Rs.5,000 crore

i. The capital requirement by the private banks has been fixed between …………… by the rating agency.

(i) Rs.48,000 crore and Rs. 1,25,000 crore

(ii) Rs.25,000 crore and Rs.48,000 crore

(iii) Rs.25,000 crore and Rs.38,000 crore

(iv) Rs.45,000 crore and Rs.48,000 crore

Answer:

(ii) Rs.25,000 crore and Rs.48,000 crore

j. How the banks are taking advantage of the buoyancy in the capital market?

(i) By making it the largest fund-raise from the markets in any year.

(ii) By making it the fastest fund-raise from the sellers in a month.

(iii) By issuing fresh equity.

(iv) By issuance of banks this year to get largest fund-raise.

Answer:

(i) By making it the largest fund-raise from the markets in any year.

k. Which bank has got permission to sell parts of its stake to its JV partners?

(i) HDFC

(ii) IDBI

(iii) Kotak Mahindra

(iv) SBI

Answer:

(ii) IDBI

l. ICICI also sold a stake in ICICI Prudential Life Insurance.

(i) 0.5%

(ii) 1.0%

(iii) 1.5%

(iv) 2.5%

Answer:

(iii) 1.5%

![]()

5. Read the passage carefully.

TCS has worst qtr ever, sees recovery from Q3

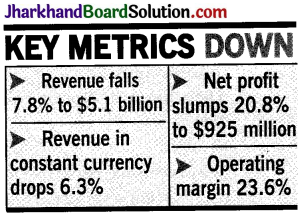

Tata Consultancy Services (TCS) saw perhaps its worst performance ever in the first quarter of this fiscal year. Revenue dropped 7.8% to $5.1 billion, compared to the same period last year. Prior to this, the biggest decline was during the financial crisis — revenue in the second quarter of 2009-10 had fallen 2.3%. Revenue declines have been extremely rare in IT services.

In constant currency terms, the decline in the last quarter was 6.3%. Net income tanked 21% to $925 million, while operating margin slid to 23.6% — way below the company’s desired level of 26-28%. TCS is the first of the major IT companies to come out with the results for the first quarter.

CEO Rajesh Gopinathan said the company expects recovery from the third quarter of this fiscal, led by business from Europe, as the US and UK continue to remain bettered by the impact of the pandemic. “Europe is most ahead in the recovery curve as most customers in June have seen good traction and the geography will go back to a higher growth trajectory in the course of year,” Gopinathan said.

The US, the biggest market for most IT companies, remains the most impacted. The UK, Gopinathan said, is the most “unfortunate” due to the twin impact of Brexit and Covid-19 playing out.

For the quarter, Europe’s revenue in constant currency was up 2.7%, North America was down 6.1% and UK was down 8.5%. BFSI was down about 5%, retail was down 13% and manufacturing was down 7%. Only life sciences was up 14%.

“Our visibility in Q3 is better now as compared to our outlook last quarter. The recovery trajectory from here will be faster than post GFC (Great Financial Crisis of 2008-2009) due to the coordinated and large responses from governments. That should play out and we see the benefit of it,” Gopinathan said. Chief operating officer NG Subramaniam said customers who have adopted digital are seeing resilience in their operations.

CFO V Ramakrishnan said when there’s such a revenue decline, it will impact margins. “We used other efficiency levers to limit the impact of the sharp revenue decline during the quarter, including no salary increase and hiring freeze,” he said.

TCS global HR head Milind Lakkad described US President Donald Trump’s decision to suspend H-1B and L-l work visas as unfortunate and unfair. “There will be a business impact in the short-term,” Lakkad said. (Courtesy: The Times of India)

Word-Meaning: Decline — decrease, reduce, Pandemic — prevalent over the world, Traction — | l grip, adhesion, Trajectory – route, track, Resilience – flexibility

On the basis of your understanding of the above passage, answer any ten of the questions given below by choosing the most appropriate option: [10 x 1 = 10]

a. In the first quarter of this fiscal year, TCS saw a revenue drop of

(i) 6.3%

(ii) 7.8%

(iii)20.8%

(iv) 23.6%

Answer:

(ii) 7.8%

b. The desired operating margin of TCS is generally

(i) 28-26%

(ii) 21-23.6%

(iii) 26-28%

(iv) 21-24%

Answer:

(iii) 26-28%

c. The CEO of Tata Consultancy Services is

(i) N. G. Subramaniam

(ii) V. Ramakrishnan

(iii) Milind Lakkad

(iv) Rajesh Gopinathan

Answer:

(iv) Rajesh Gopinathan

d. The company is dependent on whom for recovery in the third quarter of this fiscal year?

(i) Asia

(ii) Africa

(iii) Europe

(vi) None of these

Answer:

(iii) Europe

e. Why according to the CEO of TCS, UK is the most ‘unfortunate’ nation?

(i) Twin impact of Brexit and Covid-19

(ii) H-1B and L-l work visas suspension

(iii) Impact of war IT companies

(iv) All of the above

Answer:

(i) Twin impact of Brexit and Covid-19

f. Efficiency levers used by TCS to limit revenue decline are

(i) seeking government assistance

(ii) no salary increase and hiring freeze

(iii) customer’s reliance on digital operations

(iv) relying on Europe’s revenue in constant currency

Answer:

(ii) no salary increase and hiring freeze

g. Which is the biggest market for most IT companies?

(i) chine

(ii) UK

(iii) US

(iv) India

Answer:

(iii) US

h. According to the TCS global HR head, what is unfortunate and unfair?

(i) Fall in production

(ii) Pandemic

(iii) Revenue decline

(iv) H-1B and L-l work visas suspension

Answer:

i. According to Gopinathan, the visibility in Q3 is

(i) better

(ii) average

(iii) good

(iv) normal

Answer:

(iv) normal

j. Revenue in constant currency for retail and manufacturing was down by …………. and ……………. respectively.

(i) 6.1% and 8.5%

(ii) 13% and 7%

(iii) 5% and 7%

(iv) 14% and 13%

Answer:

(i) 6.1% and 8.5%

k. In which sector has revenue declined extremely?

(i) Banking services

(ii) Telecom sector

(iii) Education sector

(iv) IT services

Answer:

(iv) IT services

l. Which customers are seeing resilience in their operations?

(i) Digital

(ii) Loyal

(iii) New

(iv) Impulsive

Answer:

(i) Digital

![]()

6. Read the passage carefully.

Factory output shrinks 35% but pace of decline narrows

Fall in May is 3rd Month in a Row As Lockdown Takes Toll

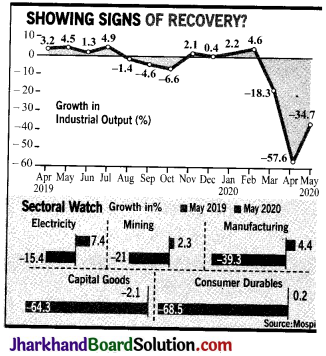

The country’s factory output contracted sharply for the third consecutive month in May as the national lockdown imposed to contain the spread of the deadly coronavirus took a toll on several sectors such as manufacturing, but the pace of decline narrowed.

The National Statistical Office (NSO) only released the index numbers as a majority of the industrial sector establishments were not operating since the end of March. This has had an impact on the items being produced by the establishments during the period of lockdown and the subsequent periods of conditional relaxations in restrictions, it said.

The government had earlier said that it would not be correct to compare the numbers with the previous months due to data constraints.

According to the NSO, the index for the month of May 2020, stands at 88.4 as compared to 53.6 for April 2020, indicating a graded pick-up in industrial activity in the economy. The data, however, showed that the index of industrial production (IIP) contracted 34.7% in May compared to and expansion of 4.5% in the year ago month. The key manufacturing sector contracted 39.3% during the month compared to an expansion of 4.4% in the year earlier period. The capital goods and consumer durables sectors recorded sharp contractions of over 60% in May, highlighting subdued investment climate and weakness in consumer demand in the economy. However, the extent of negative growth has been lower in May than April, economists said.

“Economic activity is likely to tread a bumpy path in the coming month,” said Aditya Nayar, principal economist at ratings agency ICRA. Nayar said the biggest pick-up was displayed by infrastructure/construction goods sector, the contraction in which halved to 42% in May 2020 from 84.7% in April 2020. driven by cement and steel.

Economic activity has restarted and several sectors have shown some pickup in demand, prompting the government to say that green shoots of revival are visible. But the economy remains under severe stress with most forecasts pointing to a deep contraction in 2020-21, with a possibility of a feeble rebound next year. (Courtesy: The Times of India)

Word-Meaning: Lockdown – restricted access, Subsequent shrinking, Constraints – restriction, limitation

![]()

On the basis of your understanding of the above passage, answer any ten of the questions given below by choosing the most appropriate option: [10 x 1 = 10]

a. Write the full form of NSO from the passage.

(i) Native Statistical Office

(ii) Native Statistical Organisation

(iii) The National Statistical Office

(iv) Neglected Small Organisations

Answer:

(iii) The National Statistical Office

b. Who is Aditya Nayar?

(i) Principal economist at ratings agency ICRA

(ii) Head of NSO

(iii) In-charge of ICRA

(iv) Head of Industrial Union

Answer:

(i) Principal economist at ratings agency ICRA

c. What is the full form of IIP?

(i) Index of Industrial Programme

(ii) Index of Industrial Production

(iii) Industry of Index production

(iv) Indian Industrial Programme

Answer:

(ii) Index of Industrial Production

d. “Economic activity is likely to tread a bumpy path in coming months.” The statement belongs to …………….

(i) NSO

(ii) IIP

(iii) Aditya Nayar

(iv) Foreign Economist

Answer:

(iii) Aditya Nayar

e. According to NSO, what does the Index of May 2020 stand at?

(i) 53.6%

(ii) 36.6%

(iii) 88.4%

(iv) 34.7%

Answer:

(iii) 88.4%

f. Which sector recorded sharp contractions in May 2020?

(i) Manufacturing sector

(ii) Capital goods and consumer durable sectors

(iii) Industrial sector

(iv) All of the above

Answer:

(ii) Capital goods and consumer durable sectors

g. Why did the country’s output contract sharply for the third consecutive month in May?

(i) Low production

(ii) Due to lockdown

(iii) Less demand

(iv) None of these

Answer:

(ii) Due to lockdown

h. What was the status of the extent of negative growth in May, according to economists?

(i) It was great.

(ii) There was no status.

(iii) Status remains same as in April.

(iv) Lower than April

Answer:

(iv) Lower than April

i. The index of industrial production (IIP) contracted 34.7% in May to an expansion of ………….

(i) 39.3% during the month

(ii) 4.4% in the year

(iii) 4.5% in the year-ago month

(iv) 34.7% in the year

Answer:

(iii) 4.5% in the year-ago month

j. According to Aditya Nayar, which sector displayed the biggest picke-up?

(i) Infrastructure/ construction goods sector

(ii) Consumer durable sector

(iii) Manufacturing sector

(iv) None of the above

Answer:

(i) Infrastructure/ construction goods sector

k. Is economy under severe stress in 2020-21, according to the passage?

(i) No

(ii) Yes

(iii) Perhaps

(iv) Not clear

Answer:

(ii) Yes

l. Have several sectors shown some pick up in demand, according to the graph?

(i) No

(ii) Yes

(iii) Not clear

(iv) None of these

Answer:

(ii) Yes

![]()

7. Read the passage carefully.

Google eyes $4bn Jio stake to expand Indian tech play

Tech Giant To Source Funds From $10Bn Reserved For India

A day after Google said it would invest $10 billion in India, the US company is considering to spend a good portion of that amount for a stake in Jio Platforms. The move is part of its plan to join rival Facebook in upping its play in one of the world’s biggest Internet services markets.

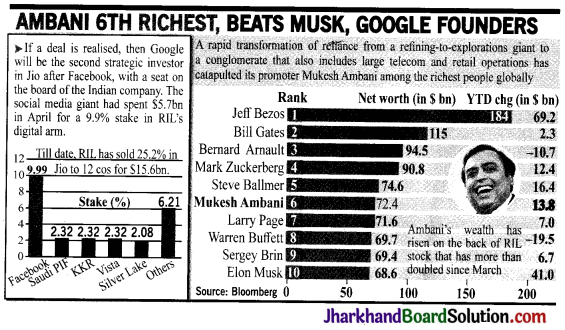

Google, according to Bloomberg, is in talks to acquire a $4-billion (Rs 30,000-crore) stake in Jio, the digital technology arm of billionaire Mukesh Ambani’s sprawling conglomerate Reliance Industries (RIL). If the talks convert into a transaction, then Google will be the second strategic investor in Jio after Facebook, with a seat on the board of the Indian company. Facebook has spent $5.7 billion (Rs 43,574 crore) for a 9.9% stake in Jio.

RIL didn’t respond to the query based on the Bloomberg report, while Google couldn’t be contacted for immediate comments.

While announcing its $ 10-billion commitment to India, Google CEO Sundar Pichai had said that the company will route the investment through equity deals, partnerships and other structures. The US tech major already has investments in Indian companies such as local delivery app Dunzo.

Google, whose Android mobile operating system powers a bulk of India’s 50 million smartphones, is looking at various opportunities to ramp up its play here. And Jio, which counts 400 million subscribers on its wireless network, offers the largest base of customers. So far, RIL has sold a quarter of Jio to 12 foreign investors, raising Rs 1.18 lakh crore (nearly $ 16 billion) in total. Aside from Facebook, the rest 11 shareholders in Jio are investment funds.

Jio, worth Rs 5,16 lakh crore, is at the core of Ambani’s plan to transform RIL from a refining- to-exploration company to a tech major. All the deals in Jio are a precursor to Ambani’s main plan of taking the digital company public in the future. Ambani may explore an overseas listing for Jio, possibly Nasdaq, after India proposed direct listing of companies in certain foreign jurisdictions. (Courtesy: The Times of India)

Word-Meaning: Conglomerate – mixture, Query – inquiry, Transform – change, transfigure

![]()

On the basis of your understanding of the above passage, answer any ten of the questions given below by choosing the most appropriate option: [10 x 1 = 10]

a. Who is the sixth richest person in the world, according to the passage?

(i) Larry Page

(ii) Mukesh Ambani

(iii) Sundar Pichai

(iv) Bill Gates

Answer:

(ii) Mukesh Ambani

b. What is the net worth of Mukesh Ambani?

(i) $4 billion

(ii) $5.7 billion

(iii) $16 billion

(iv) $72.4 billion

Answer:

(iv) $72.4 billion

c. If the deal mentioned in the passage is realised, then what will happen?

(i) Facebook will become one of the biggest internet service providers.

(ii) Facebook will become third largest service provider.

(iii) Google will be the second strategic investor in Jio after Facebook.

(iv) None of these

Answer:

(iii) Google will be the second strategic investor in Jio after Facebook.

d. How much have been spent by Facebook in Jio to get 9.9% stake?

(i) 5.9 billion

(ii) 43,570 crore

(iii) 9.9 billion

(iv) $5.7 billion (Rs.43,574 crore)

Answer:

(iv) $5.7 billion (Rs.43,574 crore)

e. According to Bloomberg, how much stake dose Google want to acquired?

(i) $4 billion

(ii) $9.9 billion

(iii) 72.4 billion

(iv) 15.6 billion

Answer:

(i) $4 billion

f. How much amount would Google invest in India?

(i) Rs. 10,000 crore

(ii) $10 billion

(iii) Rs.43,574 crore

(iv) $19.5 billion

Answer:

(ii) $10 billion

g. How will Google route the investment in India?

(i) Via Facebook and JIO

(ii) Through equity deals, partnerships and other structures

(iii) Via offering the largest share in Google

(iv) All of these

Answer:

(ii) Through equity deals, partnerships and other structures

h. Name the local delivery app mentioned in the passage.

(i) Dunzo

(ii) Zapier

(iii) Learn Dash

(iv) Lawyaw

Answer:

(i) Dunzo

i. Jio counts subscribers on its wireless network.

(i) 1.18 lakh

(ii) 5.16 lakh

(iii) 400 million

(iv) 12 foreign investors

Answer:

(iii) 400 million

j. The android mobile operating system of Google powers a bulk of India’s …………… .

(i) 400 million

(ii) 500 billion

(iii) 500 million

(iv) 12.5 million

![]()

8. Read the passage carefully.

As personal & small biz loans crash, bank lending in April shrinks ₹1.1 L cr

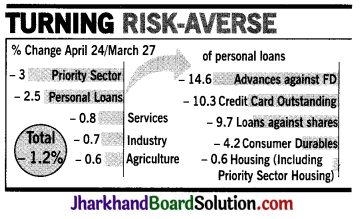

Bank lending has shrunk by Rs 1.1 lakh crore during the four weeks ended April 24 to Rs 91.5 lakh crore. While such a decline is not unusual, this year the drop was entirely because of loans to individuals in the personal segment shrinking by nearly Rs 63,000 crore and to micro and small enterprises by nearly Rs 50,000 crore during the period which coincided with Lockdown 1.0 and the first half of Lockdown 2.0.

In percentage terms, the sharpest drop was in the personal segment with middleclass borrowing for consumption through credit card outstanding and advances against fixed deposits and shares falling by over 10%. Most Indians in this period stayed home, unable to go out and spend or order anything online other than food and groceries.

The personal loan segment saw outstanding advances decline by Rs 62,861crore to Rs 24.9 lakh crore. According to data released by the RBI, the total bank credit as on April 24 stood at Rs 91.5 lakh crore — a dip of 1.2% from Rs 92.6 lakh crore on March 27. Loans to micro and small enterprises in the priority sector shrunk 4.2% in four weeks to Rs 11 lakh crore from Rs 11.49 lakh crore. While the lockdown has clearly brought down demand, many private banks, which were active in the retail and personal loan segments, turned risk-averse by tightening credit standards and reducing exposure.

The Rs 11,116-crore drop in credit card outstanding is largely explained by the closure of all non-essential retail outlets, including online ones, during the lockdown. Credit card outstanding, which had crossed Rs 1.08 lakh crore in March 2020, has declined to Rs 96,978 crore in April. The drop in loan against shares and FDs also appears to be reflecting a decline in consumption.

Loans against FDs fell 14% to Rs 60,975 crore while loans against shares dropped 10% to Rs 4,818 crore in April 2020.

The sectors which saw an expansion in bank credit included large industry, where banks lent an additional Rs 8,900 crore, retail trade where loans grew by nearly Rs 7,000 crore and, surprisingly, non-banking financial companies, where banks lent an additional Rs 5,000 crore. Loans to the services segment did reasonably better, shrinking only 0.8% to Rs 25.74 lakh crore from Rs 25.94 lakh crore a month earlier. In the services sector, transport operators were the biggest borrowers in April. Loans outstanding to this sector grew 3% to Rs 1.48 lakh crore. The demand for loans was the lowest in the wholesale trade segment, where outstanding loans fell by 5% to Rs 2.49 lakh crore.

To help banks overcome their risk aversion, the government has come out with a scheme to guarantee loans to businesses that have an outstanding credit limit of up to Rs 25 crore. This will include MSMEs and other small businesses. (Courtesy: The Times of India)

Word-Meaning: Shrinking – getting smaller in size, Segment – section, portion, Reducing – decreasing, Consumption – utilisation

![]()

On the basis of your understanding of the above passage, answer any ten of the questions given below by choosing the most appropriate option: [10 x 1 = 10]

a. RBI data states that the total bank credit as on April 24 stood at

(i) Rs. 91.5 lakh crore

(ii) Rs. 92.6 lakh crore

(iii) Rs. 24.9 lakh crore

(iv) Rs. 21.6 lakh crore

Answer:

(i) Rs. 91.5 lakh crore

b. Rs. 11,116 crore drop in credit card outstanding is due to

(i) Covid-19

(ii) Bank scam

(iii) Closure of all non-essential retail outlets

(iv) All of the above

Answer:

(iii) Closure of all non-essential retail outlets

c. Loans against FDs and shares have dropped and respectively in April 2020.

(i) 14%, 10%

(ii) 15%, 10%

(iii) 10.3%, 9.7%

(iv) 9.7%, 4.2%

Answer:

(i) 14%, 10%

d. In which segment was the sharpest drop of bank loans seen?

(i) Priority sector

(ii) Agriculture sector

(iii) Services sector

(iv) Personal loans

Answer:

(iv) Personal loans

e. Which sectors saw expansion in bank credit?

(i) Services sector, consumer durables and priority sector

(ii) Large industry, retail trade and non-banking financial companies

(iii) Retail trade, personal loans and housing

(iv) Non-banking financial companies and priority sector

Answer:

(ii) Large industry, retail trade and non-banking financial companies

f. Based on the report, loans to micro and small enterprises shrunk by

(i) Rs. 63,000 crore

(ii) Rs. 50,000 crore

(iii) Rs. 62,861 crore

(iv) Rs. 60,975 crore

Answer:

(ii) Rs. 50,000 crore

g. Who were the biggest borrowers in the services sector in April?

(i) Transport operators

(ii) Retail industry

(iii) Real Estate

(iv) Media and communications

Answer:

(i) Transport operators

h. What is the government doing to overcome banks’ risk aversion?

(i) Launching schemes to guarantee loans with credit limit of up to Rs 25 crore

(ii) Tightening credit standards and reducing exposure

(iii) Both (i) and (ii)

(iv) None of the above

Answer:

(i) Launching schemes to guarantee loans with credit limit of up to Rs 25 crore

i. Which segment had the lowest demand for loans?

(i) Retail trade

(ii) Agriculture

(iii) Personal

(iv) Wholesale trade

Answer:

(iv) Wholesale trade

j. Loans to the services segment has shrunk only by

(i) 0.1%

(ii) 0.8%

(iii) 0.7%

(iv) 0.6 %

Answer:

(ii) 0.8%

k. What has clearly brought down demand?

(i) Lockdown

(ii) Less production

(iii) Less consumption

(iv) All of these

Answer:

(i) Lockdown

l. According to RBI data, the percentage dip in total bank credit is

(i) 2.2%

(ii) 4.2%

(iii) 1.2%

(iv) 3.2%

Answer:

(iii) 1.2%

![]()

9. Read the passage carefully.

Infosys does much better than peers in Q1

Infosys put up a stellar show in comparison with its peers in the first quarter. That, together with its big contract win from US investment firm Vanguard, took the Bengaluru-based company’s share price up by 12% in morning trades on the NYSE.

The company announced its results after markets closed in India. But here too, the share price on Wednesday was up over 6%, mainly on account of the Vanguard deal, which sources tell TOI is worth about $700 million.

“We had an exceptionally good quarter. Our confidence and visibility for the rest of the year is improving, driven by our Q1 performance and large deal wins,” said CEO Salil Parekh. Infosys also resumed giving revenue guidance, which it had suspended last quarter on account of the uncertainties following the Covid-19 pandemic. The company expects its growth to be flat or at best inch up by 2% this fiscal on constant currency.

The range, not surprisingly, is nowhere close to what IT services companies have been seeing in the past decade — Infosys grew at 9.8% last fiscal — and shows the massive impact of the pandemic. The guidance also shows that the company has better visibility into the future, compared to its peers. Wipro did not provide its usual quarterly guidance and said on Tuesday that it is difficult to look beyond September.

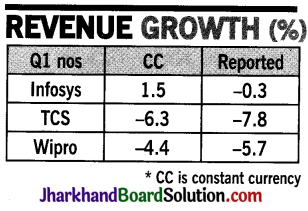

For the three months ended June 30, Infosys’ revenue was up 1.5% in constant currency compared to the same period last year. On a reported basis, revenue was down by just 0.3%. TCS’s corresponding numbers were a negative 6.3% and 7.8% respectively.

Infosys signed large deals worth about $1.8 billion in the quarter and, out of the 15 deals, five were from the BFSI (banking, financial services and insurance) vertical. Some demand in banking is coming back in the US and Asia-Pacific Zone, while capital markets, cards and payments space continue to face challenges, chief operating officer UB Pravin Rao said. Overall, the financial services business was up 2.1% in constant currency against last year. A large part of deal wins was driven by digital, which grew at 25.5% and now contributes 44.5% of the top line.

Operating margin jumped 220 basis points (100bps = 1 percentage point) to 22.7% largely aided by various cost-reduction measures, including lower advertisement and marketing spends, freeze on salary hikes, negligible travel and visa costs, and the benefit of rupee depreciation. Net profit was up 3.1% to $564 million. (Courtesy: The Times of India)

Word-Meaning: Peers – persons of the same age or position, Visibility – the state of being seen, j Constant – continuous, Corresponding – alike, Negligible – minor, Depreciation – reduction, fall

![]()

On the basis of your understanding of the above passage, answer any ten of the questions given below by choosing the most appropriate option: [10 x 1 = 10]

a. Infosys’ share price in morning trades on the NYSE was up by

(i) 11%

(ii) 12%

(iii) 13%

(iv) 14%

Answer:

(ii) 12%

b. Which company did not provide its usual quarterly guidance?

(i) Infosys

(ii) Reliance

(iii) Wipro

(iv) TCS

Answer:

(iii) Wipro

c. Who is the CEO of Infosys?

(i) Salil Parekh

(ii) Thierry Delaporte

(iii) Pravin Rao

(iv) None of the above

Answer:

(i) Salil Parekh

d. The full form of BFSI is

(i) Banking Financial Service Institute

(ii) Banking Financial Service Insured

(iii) Banking, Financial services, and Indemnity

(iv) Banking, Financial services, and Insurance

Answer:

(iv) Banking, Financial services, and Insurance

e. TCS’ constant currency revenue growth for the first quarter (Ql) is

(i) 1.5%

(ii) 4.4%

(iii) 2%

(iv) 6.3%

Answer:

(iv) 6.3%

f. The financial services business grew in constant currency against last year.

(i) 2.1%

(ii) 3.1%

(iii) 0.3%

(iv) 1.5%

Answer:

(i) 2.1%

g. Demand in banking is coming back in which two zones?

(i) The US and India

(ii) Asia Pacific and the US

(iii) Asia Pacific and Middle East

(iv) All of the above

Answer:

(ii) Asia Pacific and the US

h. Which of these statements is true?

(i) Rupee depreciation benefited cost-reduction measures.

(ii) Net profit of Infosys was up 1.5%.

(iii) Infosys grew at 8% last fiscal,

(iv) All of these

Answer:

(i) Rupee depreciation benefited cost-reduction measures.

i. Which deal boosted Infosys stock on NYSE?

(i) Edelweiss

(ii) Vanguard

(iii) Both (i) and (ii)

(iv) None of these

Answer:

(ii) Vanguard

j. What did the guidance show about the visibility of Infosys?

(i) Better visibility into the future

(ii) Bleak visibility

(iii) Neither better nor bleak visibility

(iv) None of the above

Answer:

(i) Better visibility into the future

k. Infosys signed how many deals with the BFSI industry?

(i) 15

(ii) 14

(iii) 5

(iv) 4

Answer:

(iii) 5

l. What did Infosys suspend due to Covid-19 uncertainties?

(i) Giving revenue guidance

(ii) Advertisement and marketing spending

(iii) Signing deals with investment companies

(iv) None of the above

Answer:

(i) Giving revenue guidance

![]()

10. Read the passage carefully.

Secondary-level students take coaching most: Survey

Times View: Private coaching is a multi-million rupee industry in India. But it is the symptom of a problem, not the problem itself. Coaching centres merely fill the gap caused by lack of quality teaching especially in government schools, more so in small towns and villages. Only a sincere and sustained effort to improve education in such schools will alter the picture and prevent this huge drain on the resources of the families desperately seeking to give their children decent education.

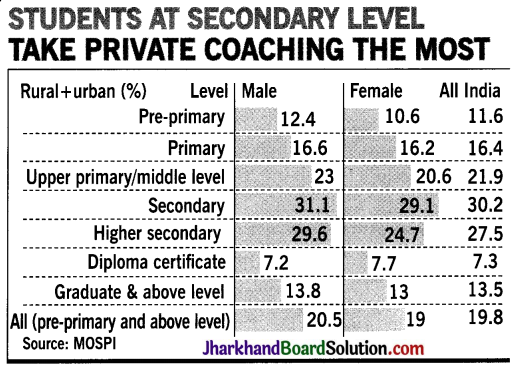

Secondary level students topped the number of students taking private coaching with 31% males and 29% female students taking recourse to. this method, a recent NSSO survey has shown. The report also showed that nearly 20% students attending pre-primary and above level (21% of males and 19% of females) were taking private coaching.

According to the final report of the 75th round of the survey information was collected on whether a student was taking/had taken private coaching relating to the basic course. Private coaching might be taken by a student individually or in a group, at home or in any other place, by a single or more tutors.

Private coaching is a thriving business across the country and according to a 2016 NSSO report more than 7.1 crore students were taking private coaching or tuition classes in addition to their basic education.

At the pre-primary level 11.6% of students across the country were taking private coaching but this number rose gradually at the upper primary and middle level to 21.9% and rose to 30.2% at the secondary level. It then tapped to 27.5% at the higher secondary level.

Experts attributed the trend of a larger share of students at the secondary level taking recourse to private coaching to the entrance exams for professional courses such as engineering and medicines.

Anil Swarup, former secretary school education in the ministry of human resource development, explained the increase of students taking private coaching to the different competitive examinations and said this was a result of the dichotomy between learning and understanding. (Courtesy: The Times of India)

Word-Meaning: Symptom – indication, Sustained-continuous, Desperately – badly, Thriving – booming, growing, Gradually – constantly, Dichotomy – disagreement

![]()

On the basis of your understanding of the above passage, answer any ten of the questions given below by choosing the most appropriate option: [10 x 1 = 10]

a. According to the recent survey of NSSO, what percentage of female students in the secondary level take private coaching?

(i) 20.6%

(ii) 21.9%

(iii) 29%

(iv) 24.7%

Answer:

(iii) 29%

b. The 2016 NSSO report states that students were taking private coaching in addition to their basic education.

(i) 7.1 crore

(ii) 7 crore

(iii) 8 crore

(iv) 8.1 crore

Answer:

(i) 7.1 crore

c. Which level of students take the highest number of private coaching in India?

(i) Higher Secondary

(ii) Upper primary/middle

(iii) Secondary

(iv) Primary

Answer:

(iii) Secondary

d. Which industry is worth multi-million rupee in India, according to the Times View?

(i) Technical education

(ii) Private coaching

(iii) Skill-based education

(iv) None of the above

Answer:

(ii) Private coaching

e. What percentage of pre-primary students take private coaching?

(i) 20%

(ii) 21%

(iii) 19%

(iv) 11.6%

Answer:

(iv) 11.6%

f. What do coaching centres do?

(i) Fill the gap caused by lack of quality teaching

(ii) Only give tuition to the students

(iii) Only develop their intelligence level

(iv) None of these

Answer:

(i) Fill the gap caused by lack of quality teaching

g. What can improve education system, according to the passage?

(i) Sincere and sustained efforts

(ii) Provide decent education

(iii) Prevent huge drain

(iv) Both (ii) and (iii)

Answer:

(i) Sincere and sustained efforts

h. For which professional courses do students take private coaching at large level?

(i) Medicines

(ii) Engineering

(iii) Both (i) and (ii)

(iv) None of these

Answer:

(iii) Both (i) and (ii)

i. Who is the former Secretary of School Education?

(i) Rajarshi Bhattacharya

(ii) Anil Swarup

(iii) Dheeraj Kumar

(iv) Sandeep Kumar

Answer:

(ii) Anil Swarup

![]()

j. Lack of quality teaching is prevalent mostly in

(i) urban areas

(ii) rural areas

(iii) small towns and villages

(iv) none of the above

Answer:

(iii) small towns and villages

k. According to the graph, which category of students take minimum private coaching?

(i) Graduate and above level

(ii) Pre-primary

(iii) Primary

(iv) Diploma Certificate

Answer:

(iv) Diploma Certificate

l. The percentage of higher secondary students taking private coaching across India is

(i) 21.9%

(ii) 30.2%

(iii) 27.5%

(iv) 31%

Answer:

(iii) 27.5%