JAC Board Class 10th Social Science Solutions Economics Chapter 3 Money and Credit

JAC Class 10th Economics Money and Credit InText Questions and Answers

Page 40

Question 1.

How does the use of money make it easier to exchange things?

Answer:

The use of money makes it easier to exchange things because

- It is accepted as a medium of exchange.

- It serves as a unit of value.

- It solves the problem of double coincidence of wants.

Question 2.

Can you think of some examples of goods/services being exchanged or wages being paid through barter?

Answer:

In rural areas, usually foodgrains are exchanged for other crops in some cases. Even in some government schemes, labourers are paid not in cash but in kind, e.g., 5 kg of wheat per day of work.

Page 42

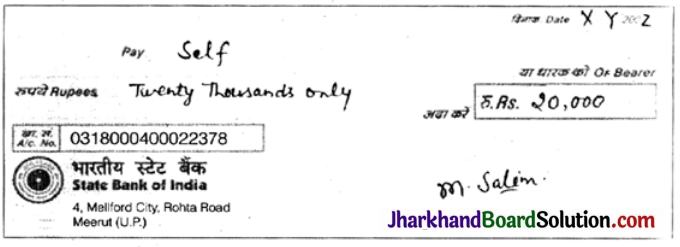

Question 3.

M. Salim wants to withdraw Rs. 20,000 in cash for making payments. How would he write a cheque to withdraw money?

Question 4.

After the transaction between Salim and Prem,

(a) Salim’s balance in his bank account increases, and Prem’s balance increases.

(b) Salim’s balance in his bank account decreases and Prem’s balance increases.

(c) Salim’s balance in his bank account increases and Prem’s balance decreases.

Answer:

(b) Salim’s balance in his bank account decreases and Prem’s balance increases.

![]()

Question 5.

Why are demand deposits considered as mqney?

Answer:

The facility of cheques against demand deposits makes it possible to directly settle payments without the use of cash. Sincb demand deposits are accepted widely as a means of payment, along with currency, they constitute money in the modem economy.

Question 6.

What do you think would happen if all the depositors went to ask for their money at the same time?

Answer:

- If all the depositors go to banks and withdraw their money at the same time, there will be a huge cash crisis in the banks as they will run out of money.

- They will not be able to give loans to markets and several companies.

- There will be no daily transaction in banks, so footfall will be nil.

- No loans can then be given as crop loans also. So this will affect the agricultural produce for the impending season.

- Bank cash reserve ratio will also decrease drastically. It will lead to a complete collapse of the financial system.

Page 44

Question 7.

Fill in the following table.

| Salim | Swapna | |

| Why did they need credit? | ||

| What was the risk? | ||

| What was the outcome? |

Answer:

| Salim | Swapna | |

| Why did they need credit? | To meet the working capital needs. | To meet the expenses of cultivation. |

| What was the risk? | No or little unknown risk. | Risk of crop failure. |

| What was the outcome? | Supplied the orders, earned profits and repaid the loans. | Crops failed found herself in the debt trap. |

Question 8.

Supposing Salim continues to get orders from traders. What would be his position after 6 years?

Answer:

If Salim continues to get orders from traders for the next six years, he can use the profits from the sales of shoes to finance his future business. Then he will nof have to borrow money from any source of credit.

Question 9.

What are the reasons that make Swapna’s situation so risky? Discuss factors – pesticides; role of moneylenders; climate.

Answer:

Pest attack, exploitation by moneylenders and lack of monsoon are the reasons that make Swapna’s situation so risky. Pesticides – Pest attack can be controlled by pesticides. Role of Money Lenders – Generally moneylenders exploit farmers. They charge very high rate of interest and farmers are caught in trap. Climate – Nearly 60% of our agricultural land area is still unirrigated. Our farmers heavily depend only on rainfall. So, climate plays an important role.

Page 45

Question 10.

Why do lenders ask for collateral while lending?

Answer:

- Collateral is an asset that the borrower owns (such as land, building, vehicle, livestocks, deposits with banks and uses this as a guarantee to a lender until the loan is repaid.

- If the borrower fails to repay the loan, the lender has the right to sell the asset or collateral to obtain payment.

Question 11.

Given that a large number of people in our country are poor, does it in any way affect their capacity to borrow?

Answer:

- The poor have low capacity to borrow since they have no collateral to offer.

- They cannot get any credit from formal sources of credit like banks and co – operatives. They mostly take loans from informal sources of credit like moneylenders, friends, relatives, etc.

![]()

Question 12.

Fill in the blanks choosing the correct option from the brackets.

While taking a loan, borrowers look for easy terms of credit. This means …………. (low/high) interest rate, ………… (easy/ tough) conditions for repayment, …………. (less/more) collateral and documentation requirements.

Answer:

While taking a loan, borrowers look for easy terms of credit. This means low interest rate, easy conditions for repayment, less collateral and documentation requirements.

Page 47

Question 13.

List the various sources of credit in Sonpur.

Answer:

Various sources of credit in village Sonpur are:

- Village moneylenders

- Traders

- Landowners as moneylenders

- Commercial banks

- Krishak co – operative society

Question 14.

Underline the various uses of credit in Sonpur in the above passages.

Answer:

Loans from co – operatives:

1. Besides banks, the other major sources of cheap credit in rural areas are the co – operative societies (or co – operatives).

2. The members of a co-operative pool in their resources for co-operation in certain areas.

3. There are several types of co-operatives possible such as farmers’ co-operatives, weavers’ co-operatives, industrial workers co-operatives, etc.

4. Krishak Co – operative functions in a village not very far away from Sonpur. It has 2300 farmers as members. It accepts deposits from its members. With these deposits as collateral, the co – operatives have obtained a large loan from the banks. These funds are used to provide loans to members.

Once these loans are repaid, another round of loans is given to ten members. Once these loans are repaid, Krishak round of lending can take place. Krishak Co – operatives provide loans fpr the purchase of agricultural implements, loans for cultivation and agricultural trade, fishery loans, loans for construction of houses and for a variety of other expenses.

Question 15.

Compare the terms of credit for the small farmer, the medium farmer and the landless agricultural worker in Sonpur.

Answer:

- Terms of credit for small farmers

- High rate of interest.

- Promise to sell crops to traders at low prices as repayment of loan.

- Terms of credit for medium farmers

- They can take loans from banks or from co-operatives who charge a very low rate of interest.

- Loan can be paid back in the next three years.

- Landless agricultural workers in Sonpur

- Borrower has no means to repay the loan in cash. So, he pledges to repay loans by working for the landowner.

- Rate of interest is high.

Question 16.

Why will Arun have a higher income from cultivation compared to Shyamal?

Answer:

Arun gets a loan from a commercial bank at a rate of interest 8.5% per annum, while Shyamal gets loans from a village moneylender at an interest rate of 5% per month (i.e., 60% per annum). Arun has the capacity to pay bank loans as compared to Shyamal. So he gets a fresh loan in next three years. Like Shyamal, he is not bound to sell his produce to the moneylenders who him a very low price. He can sell his produce at market rates.

![]()

Question 17.

Can everyone in Sonpur get credit at a cheap rate? Who are the people who can?

Answer:

Everyone cannot get credit at a cheap rate. Only the following people are able to get it:

- Who have some collateral.

- Who have organised themselves into a co – operative society.

- Who can fulfil the bank’s documentation requirements.

Question 18.

(i) Over the years, Rama’s debt

(a) will rise.

(b) will remain constant.

(c) will decline.

Answer:

(a) will rise.

(ii) Arun is one of the few people in Sonpur to take a bank loan because

(a) other people in the village prefer to borrow from the moneylenders.

(b) banks demand collateral which everyone cannot provide.

(c) interest rate on bank loans is same as the interest rate charged by the traders.

Answer:

(b) banks demand collateral which everyone cannot provide

Question 19.

Talk to some people to find out the credit arrangements that exist in your area. Record your conversation. Note the differences in the terms of credit across people.

Answer:

Do it yourself.

Page 50

Question 20.

What are the differences between formal and informal sources of credit?

| Formal Sources of Credit | Informal Sources of Credit |

| (i) Those sources of credit which are registered by the Government and have to follow its rules and regulations, e.g., banks, cooperatives. | (i) The small and scattered units which are outside the control of the Government, e.g., individual moneylenders, traders, employers, etc. |

| (ii) The RBI supervises the functioning of formal sources of credit. | (ii) There is no organization to supervise the credit activities of lenders in this sector. |

| (iii) Apart from profit making they have also an objective of social welfare. | (iii) Their only motive is to extract profit as much as possible. |

| (iv) The rate of interest charged by formal sources is much lower. | (iv) They charge very high rates of interest. |

| (v) The terms of credit are fair and reasonable. | (v) They sometimes impose very tough and unreasonable terms of credit on the borrower. |

Question 21.

Why should credit at reasonable rates be available for all?

Answer:

Credit at reasonable rates should be available for all, so that the poor people can benefit from the cheaper loans.

Question 22.

Should there be a supervisor, such as the Reserve Bank of India, that looks into the loan activities of informal lenders? Why would its task be quite difficult?

Answer:

There should be a supervisor for checking the loan activities of informal lenders. However, this task is quite difficult because informal sector constitutes many people who have different kinds of business besides lending. They are not registered with the government.

![]()

Question 23.

Why do you think that the share of formal sector credit is higher for the richer households compared to the poorer households?

Answer:

- The share of the formal sector credit is higher for the richer households because the richer households are in a better position to provide collateral and other necessary documents which are required by the banks and co – operatives.

- Richer households have means to exert pressure on banks and co – operatives to sanction loans.

- They have greater capacity to repay the loans compared to the poorer households.

JAC Class 10th Economics Money and Credit Textbook Questions and Answers

Question 1.

In situations with high risks, credit might create further problems for the borrower. Explain.

Answer:

It is true that in situations with high risks, credit might create problems for the borrower, e.g.,

- A small farmer takes a loan to meet the expenses of cultivation, hoping that his harvest would help him to repay the loan.

- But if his crop fails due to shortage of rain or for any other reason, he will be unable to repay the loan.

- In such situations a small farmer has to sell a part of his land to repay the loan.

- Such cases have high risks because the payment of loan entirely depends on good crop which in turn depends on good rain, HYV seeds, fertilizers, pesticides and other factors.

- This type of loan pushes the farmer into a debt – trap in the case of crop failure and the position of the farmer becomes worse off than before.

Question 2.

How does money solve the problem of double coincidence of wants? Explain with an example of your own.

Answer:

- Double Coincidence of Wants is an important feature of the barter system.

- In barter system, a seller needs to find a buyer who can purchase a commodity and vice versa. This condition is extremely difficult to fulfil.

- The introduction of money resulted in the end of the barter system where goods were exchanged according to the needs.

- Now, money acts as an intermediate in the exchange process, and is known as a medium of exchange. Anyone can exchange goods for money and buy commodities that are required by them.

- For example, a fruit seller wants to sell his fruits in order to buy wheat. In the absence of money, he will have to look for some person who wants to sell wheat and buy fruits. This is not easy and always possible. In case of money as a medium of exchange, the fruit seller just has to find a buyer for her fruits. Once fruits are exchanged for money, she can purchase wheat from the market.

Question 3.

How do banks mediate between those who have surplus money and those who need money?

Answer:

- Barfks act as a mediator between people who have surplus money and people who need money, by allowing them to open an account.

- People, who have surplus cash, deposit their money in a bank.

- The bank pays a fixed amount of interest on the savings.

- This surplus money deposited by the people is given in the form of loan to the people who need money.

- Banks charge a particular rate of interest to those it grants loan.

Question 4.

Look at a 10 rupee note. What is written on top? Can you explain this statement?

Answer:

At the top of a 10 rupee note, it is written ‘Reserve Bank of India’ along with a statement, “guaranteed by the Central Government”. This statement implies that the Reserve Bank of India issues currency on behalf of the Central Government. No other person or organisation apart from the RBI has the right to issue money.

Question 5.

Why do we need to expand formal sources of credit in India?

Answer:

We need to expand the formal source of credit in India, as:

- In rural areas the informal source of credit such as moneylenders charge very high rate of interest from the people.

- In such a situation, a borrower is usually caught in a debt trap.

- The formal sources of credit provide loans to people at a cheaper rate of interests which benefits the farmers and small self – employed people.

Question 6.

What is the basic idea behind the SHGs for the poor? Explain in your own words.

Answer:

- The idea is to organise rural poor, particularly women, into small Self Help Groups (SHGs) and pool (collect) their savings.

- SHG has 15 – 20 members from the neighbourhood, who meet and save regularly ranging from 25 to 100 or more.

- Members can take small loans from the group to meet their needs at a reasonable rate of interest and without much documentation process.

- After a year or two, if the group is regular in savings, it becomes eligible for availing loan from the bank.

- Loan is sanctioned in the name of group and is meant to create self-employment opportunities for the members.

- For example, small loans are provided to the members for releasing mortgaged land, for meeting working capital needs (e.g buying seeds, fertiliser, raw materials like bamboo and cloth) for housing materials and for acquiring assets like sewing machines, hand looms, cattle, etc.

- Most of the important decisions regarding the savings and loan activities are taken by the group members.

- The group is responsible for the repayment of the loan.

Question 7.

What are the reasons why the banks might not be willing to lend to certain borrowers?

Answer: Banks might not provide loans to certain borrowers because of the following reasons:

- People with lack of collateral such as house, livestock or any other property as a guarantee.

- Lack of permanent job

- Low credentials of the person on previously taken loans.

Question 8.

In what ways does the Reserve Bank of India supervise the functioning of banks? Why is this necessary?

Answer:

- A number of borrowers do not have collateral against loans.

- Collateral is an asset that the borrower owns and pledges as a guarantee to the lender until the loan is repaid.

- The main demand for loans is for crop production. Repayment of the loan is crucially dependent on the income from farming.

- Repayment depends on the risks in the situation. That is why, banks have no interest to lend to such borrowers.

- Thus, the banks might not be willing to lend to those borrowers who have no collateral and whose repaying capacity is not guaranteed.

![]()

Question 9.

Analyse the role of credit for development.

Answer:

- Cheap and affordable credit is crucial for the country’s development. Development is sustained by a proper credit policy.

- By giving loans to industries and trade, banks provide them with the necessary funds for carrying on their business without problems. This results in increased production and services, more employment and also profits.

- Caution is taken by the lenders when high risks are expected, so that there are no losses.

- Credit from the formal sector needs to be increased as loans from the informal sector, have very high interest rates, do more harm than good.

- For this reason, it is important that the formal sector gives out more loans so that borrowers are not exploited by the informal sector moneylenders, and the results will contribute to national development.

Question 10.

Manav needs a loan to set up a small business. On what basis will Manav decide whether to borrow from the bank or the moneylender? Discuss.

Answer:

Manav will decide whether to borrow from a bank or a moneylender on the following terms of the loan:

- The documentation and collateral required

- The rate of interest charged.

- The mode of repayment (periodicity, cash/ kind, etc.)

- The penalty in case of default in repayment.

Question 11.

In India, about 80 per cent of farmers are small farmers, who need credit for cultivation.

(a) Why might banks be unwilling to lend to small farmers?

(b) What are the other sources from which the small farmers can borrow?

(c) Explain with an example how the terms of credit can be unfavourable for the small farmers.

(d) Suggest some ways by which small farmers can get cheap credit.

Answer:

(a) Banks might be unwilling to lend money to the farmers in case of absence of collateral with the farmers.

(b) Other sources of credit from where small farmers can borrow are moneylenders, friends, relatives, neighbours and traders.

(c) When a farmer is charged with a high rate of interest and she/he will not be able to repay the loan. Sometimes during famine, floods or bad harvest, she/he may be forced to sell a part of her/his land. Under such circumstances, terms of credit may become unfavourable for her/him.

(d) By becoming a part of Self Help Group and by taking a loan from the credit societies, a farmer can get cheap credit.

Fill in the blanks:

Question 12.

(i) Majority of the credit needs of the ………….. households are met from informal sources.

Answer:

Majority of the credit needs of the poor households are met from informal sources.

(ii) …………… costs of borrowing increase the debt – burden.

Answer:

High costs of borrowing increase the debt – burden.

(iii) …………… issues currency notes on behalf of the Central Government.

Answer:

Reserve Bank of India issues currency notes on behalf of the Central Government.

(iv) Banks charge a higher interest rate op. loans than what they offer on ………..

Answer:

Banks charge a higher interest rate on loans than what they offer on deposits.

(v) …………. is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender.

Answer:

Collateral is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender.

![]()

Question 13.

Choose the most appropriate answer.

(i) In a SHG most of the decisions regarding savings and loan activities are taken by

(a) Bank.

(b) Members.

(c) Non – government organisation.

Answer:

(b) Members.

(ii) Formal sources of credit does not include

(a) Banks

(b) Cooperatives

(c) Employers.

Answer:

(c) Employers.